The agenda packet for the upcoming City Council Workshop (6pm) and regular meeting (7pm) on Thursday, February 19th, 2026 can be found here: https://www.towncloud.io/go/kalama-wa

Meetings are held at 320 N 1st Street, Kalama and virtually via Zoom. Virtual attendance information is included in the agenda packet. Please note, the same Zoom link will be used for the workshop and the regular meeting.

Meetings are held at 320 N 1st Street, Kalama and virtually via Zoom. Virtual attendance information is included in the agenda packet. Please note, the same Zoom link will be used for the workshop and the regular meeting.

The Kalama Civil Service Commission will hold their regular meeting on Thursday, February 26th, 2026 at 5pm in the City Council Chambers located at 320 N 1st Street, Kalama. For questions, contact records@kalamapolice.com

The Kalama City Council will hold a workshop to review Council policies & procedures on Thursday, February 19, 2026 at 6pm at the Council Chambers located at 320 N 1st Street, Kalama WA before their regular meeting at 7pm. Agenda and virtual attendance info can be found here, once posted: https://www.towncloud.io/go/kalama-wa

The Kalama Planning Commission will meet on Thursday, February 12th, 2026 at 6pm in the city council chambers located at 320 N 1st Street, Kalama. The agenda and virtual attendance information can be found here: https://www.towncloud.io/go/kalama-wa

City Council meeting recap: February 5th, 2026

Mayor Stanfill provided the council with a proposed roadmap for decision making regarding the Kalama Community Building. He reiterated the Council as the legislative body holds the decision-making authority for this facility. Staff will present the results of the UW Evan’s School of Governance project for this building at the February 19th meeting. Mayor Stanfill gave a few possible avenues for moving forward, including requesting staff to research further in specific areas of interest (approx. 1 month), or direct staff to develop language for a request for proposals (RFP). The council can then consider actual proposals from groups (or people) with interest. Mayor Stanfill also contemplated having staff develop guidelines for a community non-profit group to lease the building. The results of the city’s community building survey were provided as part of the agenda packet. This survey served as an idea generator rather than a measure of support for specific ideas. See the full agenda packet here: https://www.towncloud.io/go/kalama-wa

A workshop will be held on 2/19/26 from 6-7pm before the council meeting to review council policies and procedures.

Mayor Stanfill provided the council with a proposed roadmap for decision making regarding the Kalama Community Building. He reiterated the Council as the legislative body holds the decision-making authority for this facility. Staff will present the results of the UW Evan’s School of Governance project for this building at the February 19th meeting. Mayor Stanfill gave a few possible avenues for moving forward, including requesting staff to research further in specific areas of interest (approx. 1 month), or direct staff to develop language for a request for proposals (RFP). The council can then consider actual proposals from groups (or people) with interest. Mayor Stanfill also contemplated having staff develop guidelines for a community non-profit group to lease the building. The results of the city’s community building survey were provided as part of the agenda packet. This survey served as an idea generator rather than a measure of support for specific ideas. See the full agenda packet here: https://www.towncloud.io/go/kalama-wa

A workshop will be held on 2/19/26 from 6-7pm before the council meeting to review council policies and procedures.

The agenda packet for the upcoming City Council meeting on February 5, 2026 can be found here: https://www.towncloud.io/go/kalama-wa

Meetings are held at 320 N 1st Street, Kalama @ 7:00pm.

Meetings are held at 320 N 1st Street, Kalama @ 7:00pm.

The Kalama City offices and Kalama Public Library will be closed on Monday, January 19th, 2026 for the Martin Luther King Jr. Day holiday.

The Kalama Library Board will have their first meeting of 2026 on Wednesday, January 21st @ 5:15pm at 320 N 1st Street, Kalama. The agenda will be updated here: https://www.towncloud.io/go/kalama-wa

Happy New Year! The upcoming City Council meeting agenda for the January 15th meeting can be found here: https://www.towncloud.io/go/kalama-wa

The Kalama Civil Service's regular meeting for January 2026 has been cancelled. The next tentative meeting is scheduled for February 26, 2026 at 5pm in the City Council chambers located at 320 N 1st Street.

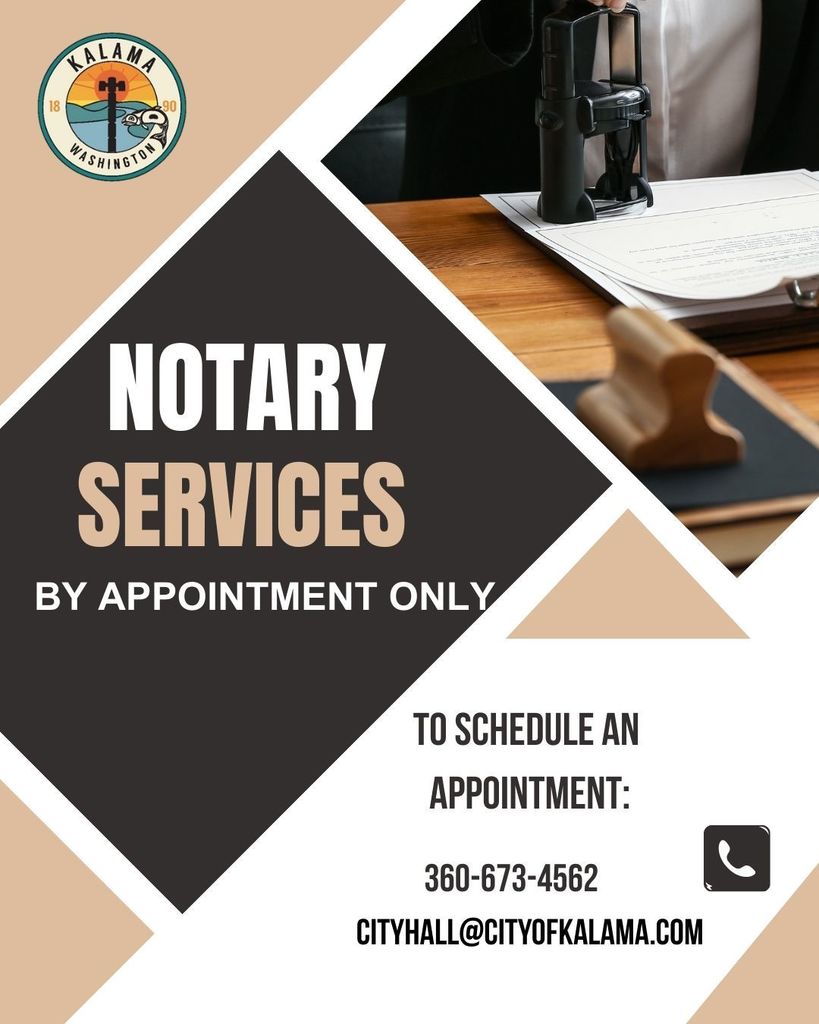

Notary services at Kalama City Hall now require an appointment. To schedule an appointment, please email cityhall@cityofkalama.com or call 360-673-4562. Each document to be notarized is unique, and this will allow our staff to schedule accordingly. Thank you for your understanding.

The Kalama Planning Commission will meet on Thursday, January 8th, 2026 @ 6pm at 320 N 1st Street, Kalama and via Zoom. The public is welcome to attend. The agenda and virtual attendance info are available through this link: https://www.towncloud.io/go/kalama-wa

The January 2026 City newsletter is available here: https://aptg.co/n0lzZL.

Simply tap or click the hyperlink to access the newsletter. Happy New Year!

Simply tap or click the hyperlink to access the newsletter. Happy New Year!

City Hall will be closed Wednesday - Friday, December 24th - 26th & Thursday, January 1st for the holidays. Wishing our Kalama community the best!

Garbage service will be delayed by one day following the holidays. If you receive Thursday service, you will be picked up on Friday. If you receive Friday service, you will be picked up on Saturday both weeks.

Garbage service will be delayed by one day following the holidays. If you receive Thursday service, you will be picked up on Friday. If you receive Friday service, you will be picked up on Saturday both weeks.

City Council Meeting 12.18.2025

Mayor Mike Reuter “passed the gavel” to incoming Mayor Jon Stanfill, and the two new Councilmembers, Rose Scattergood Council Position 1, and Paige Bozarth Council Position 2 were sworn into office. These newly elected positions are effective January 1st, 2026. The City Council reviewed the final draft of the 2026 Budget and 2026-2031 Capital Facilities Plan and adopted Ordinance 1550 finalizing the budget for the coming year. The budget is a very tight one and will be monitored closely but is balanced.

The Council also adopted Ordinance 1546 setting a 3% sewer rate increase for 2026, Ordinance 1551 increasing the utility tax 1% on water, sewer, and garbage, Ordinance 1553 adopting the recodification of the Kalama Municipal Code, and Ordinance 1554 amending the 2025 budget in the amount of $102,350.00. The Council authorized the mayor to sign the agreement with the City of Kelso for prosecutorial services.

Council authorized new signers for City bank accounts to be City Administrator Adam Smee, Mayor Jon Stanfill, and Clerk Emily Moore. They also appointed Adam Smee to act as Claims Agent for the City beginning in 2026.

Mayor and Council appointed McKenzie Taylor and Naomi Stanfield to the Library Board for 5-year terms and Colleen Peterson to the Planning Commission for a 4-year term.

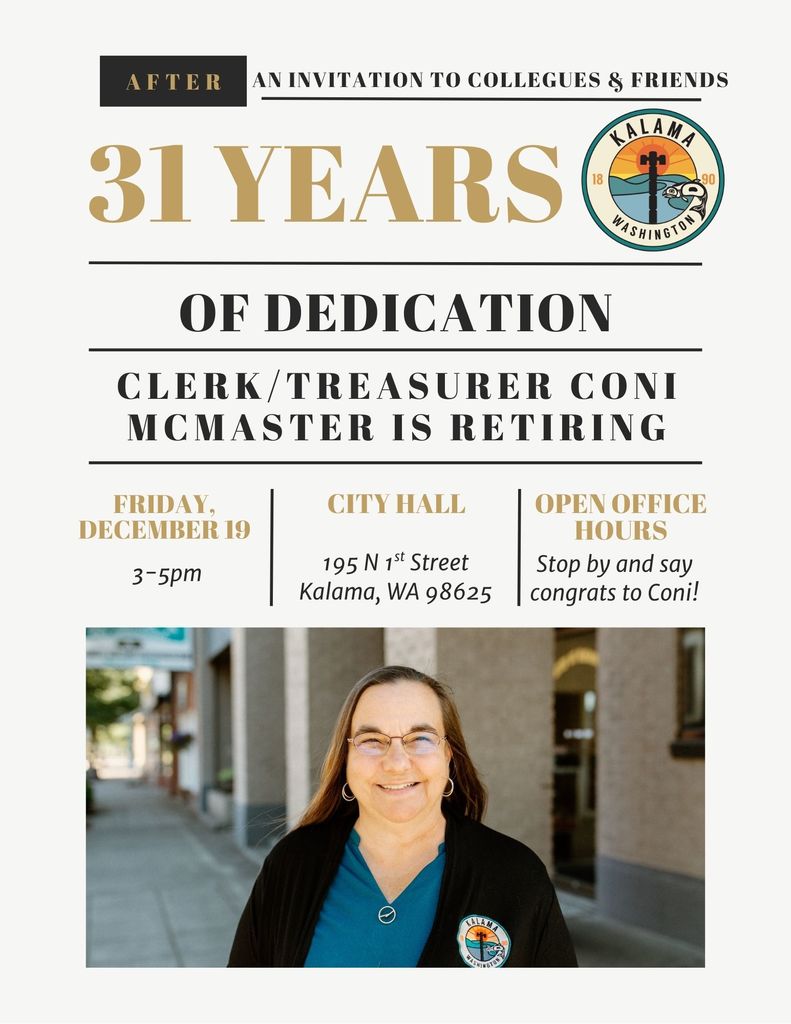

Councilmembers thanked Mayor Reuter and Councilmember Moon for their service to the City as this will be their last meeting. They also recognized Clerk/Treasurer McMaster for her service and wished her well in her retirement. Ms. McMaster thanked the community and citizens of Kalama, noting that service to the City is a group effort of all its employees, and she thanked staff, current and past, for all they do, noting they act in best interest of the city.

City offices will be closed December 24th-26th, and January 1st for the holidays. The Library will be open December 26th & 27th. Happy Holidays to all!

Mayor Mike Reuter “passed the gavel” to incoming Mayor Jon Stanfill, and the two new Councilmembers, Rose Scattergood Council Position 1, and Paige Bozarth Council Position 2 were sworn into office. These newly elected positions are effective January 1st, 2026. The City Council reviewed the final draft of the 2026 Budget and 2026-2031 Capital Facilities Plan and adopted Ordinance 1550 finalizing the budget for the coming year. The budget is a very tight one and will be monitored closely but is balanced.

The Council also adopted Ordinance 1546 setting a 3% sewer rate increase for 2026, Ordinance 1551 increasing the utility tax 1% on water, sewer, and garbage, Ordinance 1553 adopting the recodification of the Kalama Municipal Code, and Ordinance 1554 amending the 2025 budget in the amount of $102,350.00. The Council authorized the mayor to sign the agreement with the City of Kelso for prosecutorial services.

Council authorized new signers for City bank accounts to be City Administrator Adam Smee, Mayor Jon Stanfill, and Clerk Emily Moore. They also appointed Adam Smee to act as Claims Agent for the City beginning in 2026.

Mayor and Council appointed McKenzie Taylor and Naomi Stanfield to the Library Board for 5-year terms and Colleen Peterson to the Planning Commission for a 4-year term.

Councilmembers thanked Mayor Reuter and Councilmember Moon for their service to the City as this will be their last meeting. They also recognized Clerk/Treasurer McMaster for her service and wished her well in her retirement. Ms. McMaster thanked the community and citizens of Kalama, noting that service to the City is a group effort of all its employees, and she thanked staff, current and past, for all they do, noting they act in best interest of the city.

City offices will be closed December 24th-26th, and January 1st for the holidays. The Library will be open December 26th & 27th. Happy Holidays to all!

Here's a big shoutout and thank you to RailPro for their donation of railing (and installation) for the Toteff Park gazebo! This facelift was made possible by Jeremy Kushner & Dustin Vincent, and we are so appreciative! Public works has touched up the benches and will return them to the gazebo soon!

The Kalama City Council packet for December 18, 2025 meeting is available here: https://www.towncloud.io/go/kalama-wa/agendas/857

The meeting starts at 7:00pm and is open to the public. The virtual attendance information can be found on the agenda.

The meeting starts at 7:00pm and is open to the public. The virtual attendance information can be found on the agenda.

After 31 years of dedication, Clerk/Treasurer Coni McMaster is retiring. Join us on Friday, December 19th, from 3-5pm @ City Hall for open office hours to celebrate her!

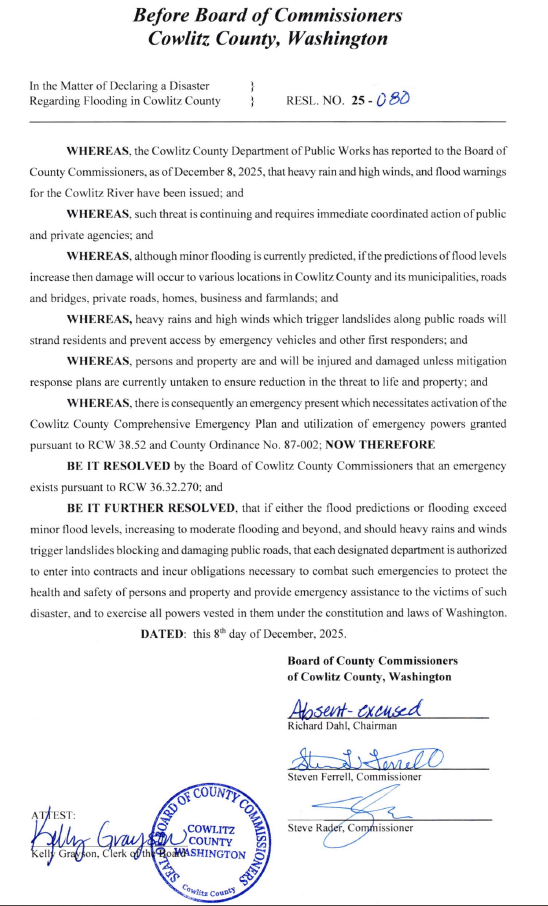

A limited number of sandbags will be available for Kalama residents and businesses today from 8am - 4:30pm at the City Public Works shop (6315 Old Pacific Hwy S, Kalama). Cowlitz County has signed disaster declaration regarding flooding in the Cowlitz County area (effective December 8, 2025).

City Council Meeting: 12.04.2025

Dan Polacek of the Port of Kalama, made a presentation on the “History Blades” that will provide an interactive walking tour through downtown Kalama. This has been in the works for a couple of years and is scheduled to be completed by the end of the year.

City Council continued their work on the 2026 Budget and Capital Facilities Plan with a presentation from Waterworth exploring various sewer rate increases and pushing planned improvements out further. City Administrator Adam Smee reported on the wastewater plant’s free capacity. City engineers ran numbers related to the current plant’s usage for the past 10 years which shows it’s operating at 81% of total capacity for TSS currently. Waterworth also addressed water rates for the 10%/15% increases to outside city limits users, noting the cost-of-service allocation they completed supported this recommendation to address equalizing the rate distribution to cover the actual costs of service.

Council reviewed the adjustments to the Tourism and Library which included the legal opinion of the attorney that it is unwise to allocate Tourism tax funding to the library. The Council wants the Library to remain open on Mondays and restored the book and janitorial expenses to make the Library whole. For the General Fund, after all the cuts and revenue changes were included, a deficit of about $90,000 remained. Councilmember Stanfill recommended the City adopt the TBD sales tax of .1% and a 1% Utility tax increase to fund the Library and the needs of General Fund (including the janitorial budget). Adding these revenue sources will bring the General Fund into balance. This proposal does not provide any contingency funding. There was also a review of the effects of shuttering the Community Building.

After much discussion the consensus of the Council was to move the following items for consideration and inclusion into the budget for finalizing the budget ordinance for December 18, 2025.

1. Increase Water Rates on outside residential 10% and outside Commercial 15%. Ordinance 1545 passed unanimously

2. Increase Sewer Rates 3% - Ordinance 1546 to be revised and presented December 18, 2025

3. Fund the Library fully providing funds for janitorial and restoring the book budget – will require additional General Funds.

4. Close the Community Building and eliminate Parks & Recreation programing.

5. Restore janitorial to Police and City Hall facilities

6. Adopt the 0.1% TBD sales tax for street operations (reducing the General Fund transfer to Streets by an equal amount) – Ordinance 1552 on agenda – Passed by a vote of 4 to 1

7. Prepare Ordinance to consider a 1% Utility Tax increase at the December 18, 2025, meeting.

The 2026 building permit fees & City fee resolutions were adopted. City Council authorized the Mayor to sign both the jail contract with Cowlitz County and the Transportation Improvement Board grant for the Taylor Road overlay accepting the grant award.

In reports it was noted the sewer line replacement project has paused work for the winter and will start again in March to complete the work. Weather reports are indicating storms bringing lots of rain are forecasted so if you see storm drains filling up, please call Public Works (360)-673-3706 or 911 during non-business hours. Christmas in Kalama is on 12/5, https://www.kalamachamber.com/holiday-parade. Celebrate Clerk/Treasurer’s retirement with us on December 19th from 3-5pm at City Hall!

Dan Polacek of the Port of Kalama, made a presentation on the “History Blades” that will provide an interactive walking tour through downtown Kalama. This has been in the works for a couple of years and is scheduled to be completed by the end of the year.

City Council continued their work on the 2026 Budget and Capital Facilities Plan with a presentation from Waterworth exploring various sewer rate increases and pushing planned improvements out further. City Administrator Adam Smee reported on the wastewater plant’s free capacity. City engineers ran numbers related to the current plant’s usage for the past 10 years which shows it’s operating at 81% of total capacity for TSS currently. Waterworth also addressed water rates for the 10%/15% increases to outside city limits users, noting the cost-of-service allocation they completed supported this recommendation to address equalizing the rate distribution to cover the actual costs of service.

Council reviewed the adjustments to the Tourism and Library which included the legal opinion of the attorney that it is unwise to allocate Tourism tax funding to the library. The Council wants the Library to remain open on Mondays and restored the book and janitorial expenses to make the Library whole. For the General Fund, after all the cuts and revenue changes were included, a deficit of about $90,000 remained. Councilmember Stanfill recommended the City adopt the TBD sales tax of .1% and a 1% Utility tax increase to fund the Library and the needs of General Fund (including the janitorial budget). Adding these revenue sources will bring the General Fund into balance. This proposal does not provide any contingency funding. There was also a review of the effects of shuttering the Community Building.

After much discussion the consensus of the Council was to move the following items for consideration and inclusion into the budget for finalizing the budget ordinance for December 18, 2025.

1. Increase Water Rates on outside residential 10% and outside Commercial 15%. Ordinance 1545 passed unanimously

2. Increase Sewer Rates 3% - Ordinance 1546 to be revised and presented December 18, 2025

3. Fund the Library fully providing funds for janitorial and restoring the book budget – will require additional General Funds.

4. Close the Community Building and eliminate Parks & Recreation programing.

5. Restore janitorial to Police and City Hall facilities

6. Adopt the 0.1% TBD sales tax for street operations (reducing the General Fund transfer to Streets by an equal amount) – Ordinance 1552 on agenda – Passed by a vote of 4 to 1

7. Prepare Ordinance to consider a 1% Utility Tax increase at the December 18, 2025, meeting.

The 2026 building permit fees & City fee resolutions were adopted. City Council authorized the Mayor to sign both the jail contract with Cowlitz County and the Transportation Improvement Board grant for the Taylor Road overlay accepting the grant award.

In reports it was noted the sewer line replacement project has paused work for the winter and will start again in March to complete the work. Weather reports are indicating storms bringing lots of rain are forecasted so if you see storm drains filling up, please call Public Works (360)-673-3706 or 911 during non-business hours. Christmas in Kalama is on 12/5, https://www.kalamachamber.com/holiday-parade. Celebrate Clerk/Treasurer’s retirement with us on December 19th from 3-5pm at City Hall!